[Use “WHATCARD20” promo code to get $20 off your first ipaymy transaction!]

Two weeks ago, I wrote an introductory article about how one is able to receive cashback from mandatory IRAS tax payments. In this article, I will explain this in greater detail and address common questions on using ipaymy’s services for IRAS tax payments.

Do I need to set up a new payment mode in IRAS?

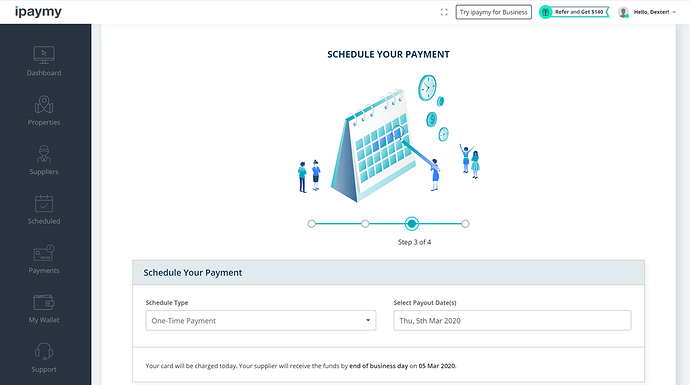

No, you do not need to do so. If you are already on Giro payment scheme (like me), all you need to do is create an account on ipaymy, and set up a one-time / recurring payment to IRAS. Then, you need to schedule a payment before your Giro deduction date. Once IRAS receives your payment from ipaymy, they will not deduct it from your bank account. If you have set this up as monthly tax payment, IRAS will not debit your bank account as long as ipaymy pays this amount.

Will I pay my income tax twice in this arrangement?

In the event that you schedule an ipaymy payment too close to the processing date of IRAS, it is entirely possible that your UOB One card is charged the monthly tax payment,while IRAS continues to debit the balance in your bank account. In this scenario, you are pre-paying your income tax; this will result in the shortening of your payment schedule by 1 month (IRAS will automatically make this adjustment).

Does the “WHATCARD20” promo code work for recurring payment?

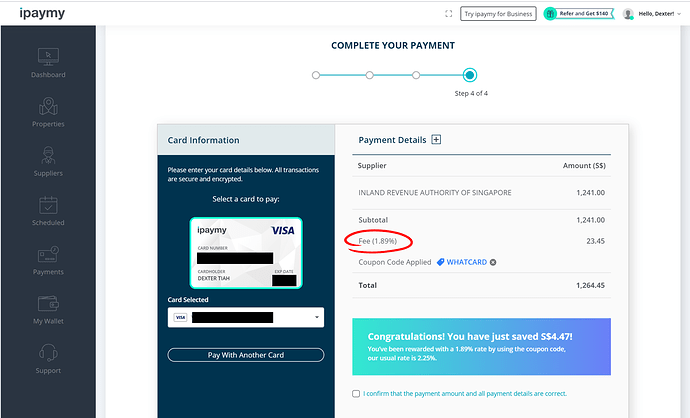

Yes, however, cashback of $20 only applies to first-time users of the service on their first transaction. Therefore, if you schedule Giro payment over 12 months, you will only get this rate on your first transaction.

Does the UOB One card work with ipaymy? There are a couple of transactions which are not recognized by UOB as eligible spending

Yes, it works. I have verified this with the business development manager at ipaymy.

Does this work with miles cards?

Absolutely! We are writing from the perspective of UOB One card, because it is the only card that has cash rewards greater than that of the admin fee. If you transact with a miles card such as Citi Premiermiles, you are effectively buying miles earned on the credit card (paying with the admin fee).

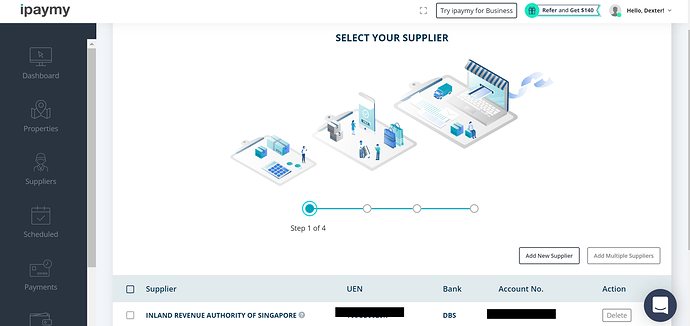

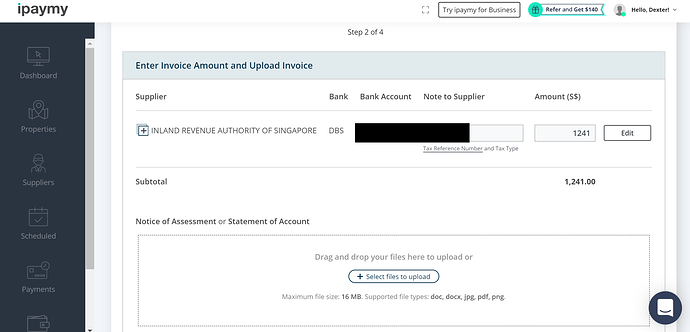

Step-by-step process

Summary

You don’t have to change your existing IRAS payment methods to take advantage of this opportunity to earn cashback on your IRAS tax payments. Once you have set up your monthly payment to IRAS via ipaymy, your bank balance will not be deducted as long as you schedule the ipaymy payment before the IRAS processing date. In a rare event, you may pay twice (for one month, pay via ipaymy as well as having your bank account debited), but because of this prepayment, you shorten your payment schedule by a month

If you would like to get the maximum rewards from your credit cards, do consider integrating WhatCard into your lifestyle to help you optimize your credit card rewards, and follow us on Facebook to stay updated on the latest tips, tricks, and hacks (like this article!) to get the most out of your credit cards

If you enjoyed this article, you may also be interested in:

- Limited Time Promo: Get $100 cash credit when you apply for UOB PRIV Amex, existing UOB cardholders also eligible

- WhatCard's list of best credit card sign up promotions

- Best credit card to top-up YouTrip : It’s (probably) not the card you are thinking of

- Why do so many people continue to use their EZ-Link cards for MRT/Bus payments?

- Video: Singapore Airlines Newark to Singapore (17.5 hours!) in Business Class

- Get up to 10% cashback when paying for your taxes, utilities and insurance bills with this simple trick

- The (plastic) X Card is back, with a 60,000 miles sign up promotion