Hi everyone! It is that time of the year again that we set out to evaluate the highest interest savings account available for our readers again!

Since our last post on this topic, the bonus interest rate you get when you fulfill certain criteria in high interest savings account has continued to be slashed (most recently by OCBC in their 360 accounts as reported by The Straits Times). It is an opportune time to see how we can maximize our interest in the low-interest rate environment today!

What is a high interest savings account?

If you or your friends are currently using savings accounts such as the DBS Multiplier, OCBC 360, or UOB One, you already know what high interest savings accounts are - they typically offer significantly higher interest rates of 1-2% per year as compared to a bank’s typical 0.05% p.a. base interest rate.

However in order to get these higher interest rates, the banks will require you fulfill other conditions such as crediting your monthly salary with the bank, spending on the bank issued credit cards, etc. High interest savings account are getting very popular these days because consumer always love higher interest rates, and banks use these as an opportunity to attract customer deposits and also build customer loyalty (i.e. make it harder for you to leave them) by tying you with multiple services across the bank.

What is the best high interest savings account for me?

At the risk of sounding like a broken record here, the best account depends very much on your personal life circumstances (just like the best combination of credit cards for yourself). However, we have found that the savings account that are popular with Singaporeans are generally tier their higher interest rates around similar categories, therefore we will do a comparison based on these categories:

- Bank account balance

- Monthly salary credit

- Credit card spending

- Giro/Bill payments

Methodology

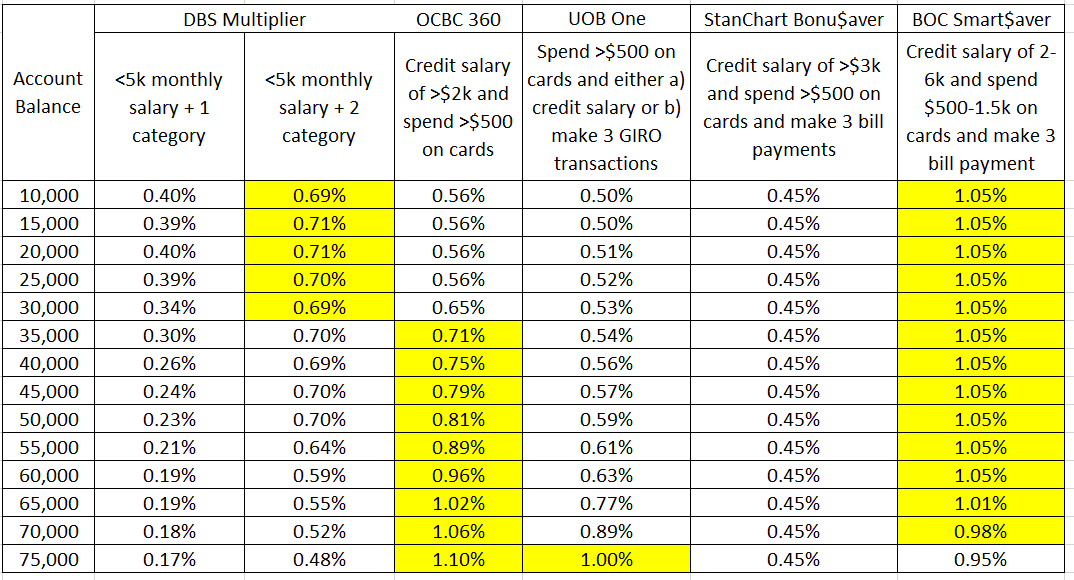

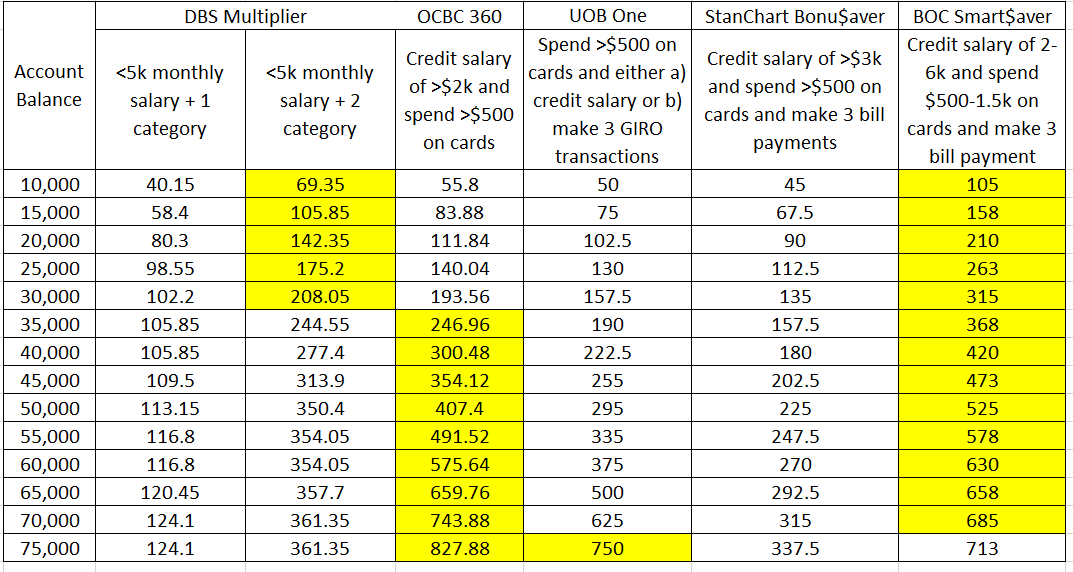

We decided to compare the popular bank accounts in terms of effective interest rate (and the absolute dollar value of interest) against bank savings, spaced $5,000 apart from $10,000 to $75,000. This is done using the bank’s own calculators on their websites (in the case of BOC Smart$aver, there is a very helpful Google Sheets calculator ).

While there are many possible permutations available, we focused on the ones that probably apply towards more mainstream savers, and base it off the below monthly assumptions:

- Salary credit of at least $2,000 (capped at $5,000)

- Credit card spending of at least $500

- At least 3 GIRO/bill payments

Here are our results based on these assumptions (we have highlighted in yellow the 2 banks in this table that give the highest interest rate):

Effective Interest Rate Received

Dollar Amount of Interest Received

What if I want even higher interest on my money than these savings account?

There are other highest interest options available, such as cash management products from robo-advisors or insurance savings plans available today for you if you want an even higher interest rate. These products are riskier, in the sense that they are not SDIC-insured or may involve a lock-in period before you can withdraw your funds (unlike these high interest savings accounts mentioned by us).

There are other personal finance bloggers who have done reviews on these other products, so we decided not to re-invent the wheel and just provide the URL to their blogposts below

Summary

As you can see, even if you keep the conditions similar the savings accounts are most competitive at different amounts of savings. Based on the numbers above, we can make a few broad recommendations of what works best:

- Go with BOC Smart$aver , period. They offer the highest (or second-highest) interest in their savings account across several different account balance levels!

- If you have $35k or less and dislike BOC (notorious for bad service), consider banking with DBS for the DBS Multiplier Account if you can hit 2 categories or OCBC 360 Account if you can’t

- If you have $35-65k in savings, the OCBC 360 Account is the next best choice for you. Should you decide to get this account, do consider supporting WhatCard by applying for it via our affiliate link here .

- If you have a UOB One Account and are lazy to set-up new bank accounts, consider consolidating up to $75,000 there to get interest rate of 1% on your funds.

If you enjoyed this article, you may also be interested in:

- Get up to $45 weekly just doing funds transfer to your friends!

- A card game that teaches you about investing while promising lots of fun with friends and family!

- WhatCard of the Week: Maybank Horizon Visa

- The best credit cards for large expenses (e.g. wedding, furniture, electronics)

- What is the value of a mile in the post Covid-19 world?

- 6 ways to invest in property with as little as $1000!

- Anatomy of the real responsible investing firm

- WhatCard’s list of best credit card sign up promotions

- This is how you set up ipaymy to reduce your IRAS tax payments