As the founders of WhatCard, our users often ask us what credit cards we ourselves use. Hence, we decided to start this new weekly credit card feature where we will be taking turns to share about a card that we ourselves own/use and talk about how we use it and potential limitations. Share with us in the comments below which card you would like us to feature for next weeks #WCOTW!

This is not a sponsored post, and all opinions are from the WhatCard team’s personal experiences with the card

Citi Cash Back + Card

Key Features:

- Annual Fee: $192.60/year, first year waived

- Sign up bonus:

- $350 for new-to-bank customers via Singsaver if you apply between 14th to 19th February

- Earn rate: 1.6% on all spend

- Minimum age: 21

- Minimum income: $30,000/year

- 14% discount at Esso stations: 5% Esso site discount + 5% Esso Smiles card discount + 4% Citi Card discount

- 14% discount at Shell stations: 5% Shell site discount + 5% Shell Escape discount + 4% Citi Card Discount

- Interest rate on purchases: 26.9% interest p.a.

Perhaps trying to appeal to broad-based cashback users, WhatCard is happy to be the first to announce the launch of the new Citi Cash Back + Card (not to be confused with the Citi Cash Back Card that offers 8% dining petrol and groceries cashback with the minimum $888/monthly spending).

Instead of minimum spending amounts and high cashback to certain categories, this new card gives a flat 1.6% cashback on all spend!

Why We Love the Citi Cash Back+ Visa Card

1. No minimum spending and no cashback cap

The problem with most of the lucrative cashback cards issued in Singapore these days are twofold. Firstly, there are high minimum spending requirements of $600-$1000/month. This is problematic for young working professionals (like myself) who do not have substantial credit card expenses to charge to the card. The moment the credit card spending is below the minimum spend, it will typically give a low cashback rate of 0.3% per dollar spent instead.

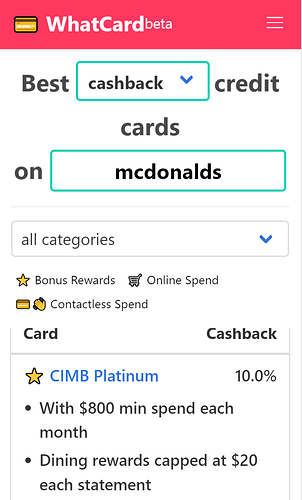

Secondly, there is usually a monthly cashback cap. This results in you having to monitor your expenses like a hawk, because any excess spending will also result in a paltry 0.3% cashback per dollar spent. One example of such a card that I just described is the CIMB Platinum Card (see below for details):

Enter: the Citi Cash Back+ Card. Incrementally better than the StanChart Unlimited Card and the Amex True Cashback Card, this card addresses both issues with a base 1.6% cashback rate on all spend, with no cashback cap. This makes it the ideal card for those of you who:

- Do not want to be bothered to monitor minimum spending requirements,

- Have large monthly expenses to charge to your card, large enough to bust the cashback dollar cap on other cards, and

- Do not want to go through the hassle of tracking differing rewards by merchant categories (sadly, if this describes you, our merchant search engine tool is not so useful for you

)

Limitations of the Citi Cash Back+ Card

1. Lower cashback than other cards that have category-specific spending

At 1.6% unlimited cashback, the cashback pale in comparison to other cards such as the DBS Live Fresh (5% cashback on contactless and online spending) or the OCBC 360 Card (6% cashback on dining, 3% on groceries, and more).

If regular expenses and willingness to invest effort/energy to manage your spending to hit the minimum spending cap and avoid the maximum cashback cap describes you, you can get higher cashback on your spending on those earlier cards mentioned, and are better off without the Citi Cash Back+ Card.

2. Poorer FX exchange rates for foreign currency transactions

There are foreign transaction fees of 3.25%, along with a potential 0.5% spread above the spot rate. In short, WhatCard does not recommend using Citi Cash Back+ Card for such transactions. Instead, exchange your cash directly at a moneychanger, or use a multi-currency wallet like YouTrip or Revolut.

You may also want to read our latest analysis on MCA accounts here.

Our Summary

Readers of this blog will know that I already have both the StanChart Unlimited Card and Amex True Cashback Card in my wallet. I encourage users (especially those without a Citibank credit card) to take advantage of current promotions now, to get $350 cash and a card that is better than both existing cashback cards due to its 1.6% cashback! If you would like to apply for one, please consider supporting the site by applying through our affiliate link below

If you would like to apply for the Citi Cash Back + Card, please consider supporting the site by applying through the above affiliate link. WhatCard was set up to help the community get the most from their credit card rewards. We have been delivering objective commentary with no ads or sponsored content, and affiliate links help us to keep the site running

If you would like to get the maximum rewards from your credit cards, do consider integrating WhatCard into your lifestyle to help you optimize your credit card rewards, and follow us on Facebook to stay updated on the latest tips, tricks, and hacks (like this article!) to get the most out of your credit cards

If you enjoyed this article, you may also be interested in:

- Why I’m still using my YouTrip card during CB

- WhatCard’s list of best credit card sign up promotions

- What is the value of a mile in the post Covid-19 world?

- 2 Months Promo: Get 10% cashback for online spending through DBS Live Fresh!

- Anatomy of the real responsible investing firm

- WhatCard’s list of best credit card sign up promotions

- This is how you set up ipaymy to reduce your IRAS tax payments