This article is a guest contribution from our friends at TheInvestQuest with some edits and is republished with the author’s permission. The original article can be found here. TheInvestQuest is a retro-game themed investment site with exciting graphics and timely content. Do check out their Facebook for easy updates and their Instagram for quiz content and infographics. Opinions expressed in this article reflect the views of the writer.

Fixed income is not sexy. They are an asset class for the retiring age group who needs a boring stable income. So why should we learn about it?

Reasons why we should learn about fixed income

1. Fixed income represents a larger share of the capital markets

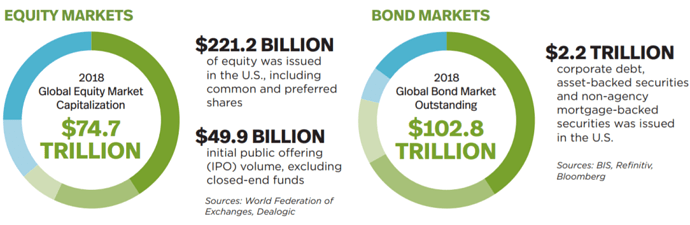

In terms of the current market amount outstanding, fixed income is of a magnitude of $103 trillion, which is larger than the global market cap of equities at US$75 trillion.

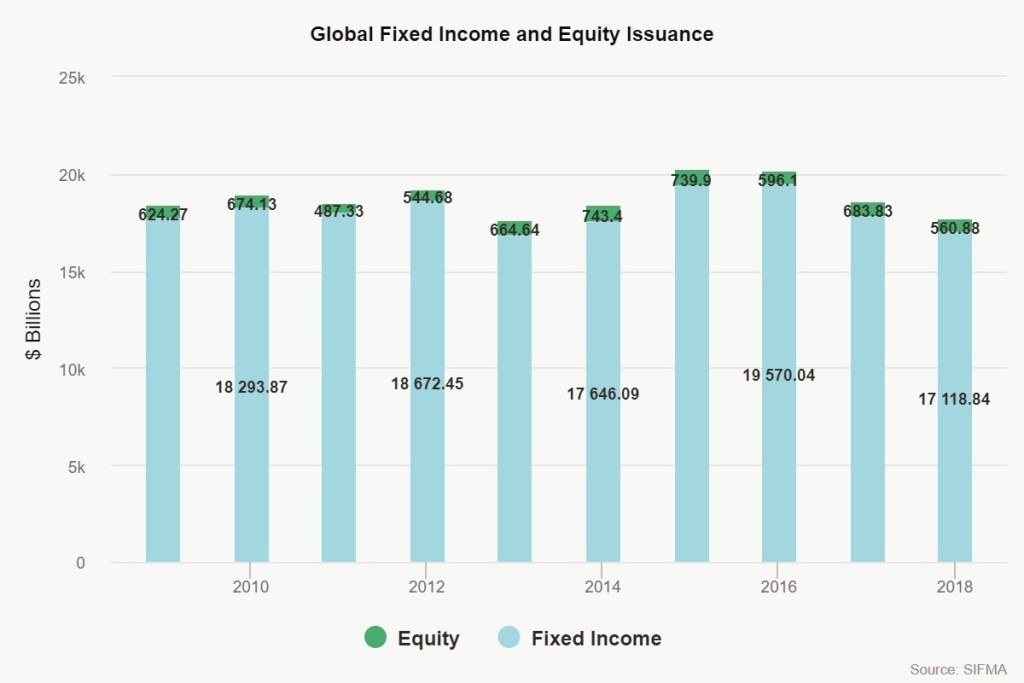

In terms of new issuances, fixed income has far outpaced new equity issuances (IPOs and rights offering) by a factor of >30x since time immemorial.

2. Another asset class to diversify your existing portfolio

Because the risk and return characteristics of fixed income is significantly different from equities, it can add value by introducing diversification to your existing portfolio at different points of the market cycle. When equities are overvalued, it can sometimes take >30 years for the investor who invested at the top of the market cycle to recover their capital!

Very often, investors look at bond yields to decide if stock markets are relatively cheap or expensive. For example, analysts compare the 10-year treasury yields vs dividend yield of the S&P 500 Index, or the BBB-rated corporate bond credit spreads vs S&P 500 earnings yield (earnings divided by index price) over time to determine the relative attractiveness of fixed income over equities. When treasury yields or corporate bond credit spreads are larger than the S&P 500’s dividends or earnings yield, it may be an attractive opportunity to invest into fixed income because it is relatively undervalued!

Example of a bond with its key investment terms

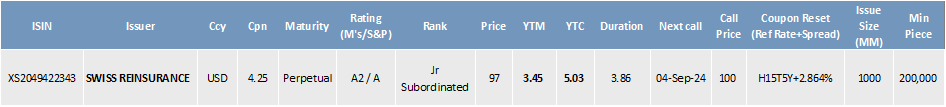

The table below shows what you might see being sent across by your financial advisor. We will explain what the terms in the columns above means:

Terms that help you IDENTIFY the bond

- ISIN: Unique reference number that allows for easy identification of a security

- Issuer : Company issuing the bond. Sometimes, there is also a guarantor, in which case the bond’s credit risk may be deemed to be the better of the issuer or guarantor.

- Currency : In what currency is the bond traded in. the same company could issue bonds denominated in different currencies

- Coupon : How much “interest” the bond pays per year. The coupon may be a fixed rate or floating rate. Coupon payment schedule is most commonly quarterly, semi-annual or annual. Zero-coupon bonds do not pay coupons and are issued at a discount to par.

- Maturity: When the bond expires and pays you back principal. Perpetual bonds, as the name suggests, do not have a maturity date.

- Credit Rating : Shows the “quality” of the issuer, higher rated bonds typically have lower risk of default. Bonds rated BBB- or higher are considered Investment-grade bonds.

- Rank or Subordination : Shows the priority of which the bonds rank in the capital structure of a company (secured, senior unsecured, subordinated, junior subordinated…in descending order of seniority). If a company has different ranked bonds, the more senior bonds will be paid back first in the event of a default scenario.

Terms that help you figure out the bond’s EXPECTED RETURN

- Price : The cost at which you are buying the bond at.

- Yield to maturity (YTM) : Assuming the provided price, the annualized return of the bond to maturity, assuming no default. If you adjust the YTM with the expected risk of default, you get to the expected return of the bond assuming you hold the bond to maturity.

- Yield to call (YTC) : Assuming the provided price, the YTC shows the annualized return of the bond to the nearest call date, assuming no default. A call feature allows the issuer to buy back the bond at a date earlier than the maturity date. If you adjust the YTC with the expected risk of default up till the call date, you get to the expected return of the bond assuming you hold the bond up to the call date .

- Duration : Measurement of how long it takes, in years, for an investor to be repaid the bond’s price by the bond’s total cash flows. It is more commonly used as an indication of how sensitive the bond price is to changes in interest rates (ie a duration of 5 would indicate that if the interest rate environment moves up by 1%, the bond price would approximately decline by 5%).

Special features the bond may have

- Next call : The earliest time the issuer may buy back the bond. Not all bonds are “callable”

- Call price : How much the issuer needs to pay to buy back the bond at the call date. High yield bonds sometimes have call prices above par.

- Coupon reset : Sometimes the bond coupon rate may be reset on a certain date onwards, most commonly to a benchmark rate (the above bond uses the 5 year US Treasury yield) + fixed rate spread (to compensate the investor for taking corporate credit risk).

Other information that you’ll need to know

- Issue size : Total amount that was issued for this bond. A larger issue size is usually preferred due to better secondary market liquidity (easier to transact the bond at tighter bid-ask spreads)

- Min Piece : The minimum denomination to trade the bond. Most bonds trade in min sizes of USD 200k. However the US has a developed bond market for retail investors, so it is not difficult to find bonds trading in min sizes of USD 1k.

If you would like to get the maximum rewards from your credit cards, do consider integrating WhatCard into your lifestyle to help you optimize your credit card rewards, and follow us on Facebook to stay updated on the latest tips, tricks, and hacks (like this article!) to get the most out of your credit cards

If you enjoyed this article, you may also be interested in:

- WhatCard of the Week: Maybank Horizon Visa

- Get 6% Cashback (capped at $60) from these online merchants with Maybank credit cards!

- Get 2% cashback (capped at $15) from online shopping with YouTrip card with no minimum spending!

- Best credit cards for large expenses (wedding, furniture/electronics) - updated for Aug 2020

- SC X Card is waiving 2nd year annual fees for all cardholders

- What is the value of a mile in the post Covid-19 world?

- 6 ways to invest in property with as little as $1000!

- Anatomy of the real responsible investing firm

- WhatCard’s list of best credit card sign up promotions

- This is how you set up ipaymy to reduce your IRAS tax payments