This article is a guest contribution from our friends at SingSaver. Opinions expressed in this article reflect the views of the writer.

What does it take to save a million dollars in your CPF Account as your retirement plan?

You may have heard about a Singaporean who accumulated a million dollars in CPF savings. Is it possible and what do you need to do if this amount is going to form the bulk of your retirement savings?

What is CPF?

CPF stands for Central Provident Fund. Managed by the Central Provident Fund Board (CBFB), it is a social security savings scheme that helps working Singaporeans and Permanent Residents save for retirement, healthcare and home ownership.

Depending on age, all working Singaporeans and Permanent Residents contribute a certain percentage of their monthly salary a month to CPF. In addition, employers also contribute a percentage of their employee’s monthly salary to their employee’s CPF.

How can you save a million dollars in your CPF?

In order to get a million dollars in your CPF, you need to max out your Special Account (SA). The CPF is composed of three portions:

- Ordinary Account (OA)

- Special Account (SA)

- Medisave Account (MA)

The OA is primarily used for providing housing, while SA is used for retirement. MA is used to pay for healthcare.

From last year ( 1 July 2019 to 30 September 2019 ), CPF interest rates went up to 3.5% p.a. on your OA and up to 5% p.a. on your SA and MA.

These interest rates include an extra 1% interest paid on the first $60,000 of a member’s combined balances (up to $20,000 from the OA). CPF interest rates are reviewed every quarter.

In addition, CPF members aged 55 and above will also earn an additional 1% interest on the first $30,000 of their combined balances (with up to $20,000 from the OA). As a result, CPF members aged 55 and above will earn up to 6% interest per year on their retirement balance.

In order to accumulate a million dollars in your CPF, the key is to move the lower interest OA money into your SA. Then, the compounding effect of 5% per annum builds up your cash reserves faster.

Note the time this takes will differ, based on how much you earn. Singaporeans below the age of 55 are required to contribute 20% of their monthly pay to CPF. Employers contribute an additional 17%.

On average, someone earning around S$3,000 a month, who starts working at 25 and constantly transfers money from OA to SA, could end up hitting the million dollar mark as early as age 54 to 57.

It’s not a get-rich-quick method, but the reliable ones rarely are.

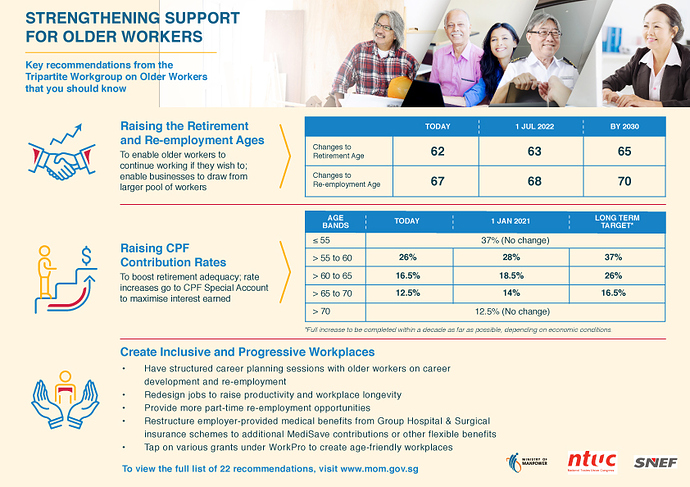

During the 2019 National Day Rally, Prime Minister Lee Hsien Loong announced plans to gradually raise the retirement age, re-employment age as well as CPF contribution rates for older workers gradually from 2021 until 2030.

The best part? The additional money will be paid into the Special Account , which accrues the highest possible interest among the CPF accounts.

Here’s what the proposed changes look like:

CPF contribution rates for older workers will be raised over the next decade or so, so the full rate of 37 per cent will be extended to those aged up to 60 before it tapers off.

For the first increase in CPF rates in 2021, employers and workers will each increase their contribution by 0.5 percentage point to 1 percentage point for workers aged 55 to 70.

For example, for someone who was 55 in January this year and earns $3,000, both he and his employer contribute 13 per cent, or $390 a month, to his CPF savings.

In January 2021, the contribution rates for each party would go up to 14 per cent, or $420 a month, assuming zero wage increments over the years. That works out to $360 more in contributions each a year for employer and employee.

All is that good news, as you can earn the maximum CPF contribution rates of 37% for longer, from the initial age of 55 to 60 years old, by 2030. Even those aged between 60 to 65, and 65 to 70, in year 2030 will benefit, earning 9.5% and 4% more CPF contributions respectively.

Note: There will be no change to CPF withdrawal ages, which remains at 55 years old. Upon reaching 55 years old, members can withdraw up to $5,000 from their Special and Ordinary Accounts, or anything above their Full Retirement Sum (FRS) in their Retirement Account (RA), whichever is higher.

Pros of putting more money in your CPF Special Account

There are a number of upsides when relying on your SA to reach your first million dollars. These are:

- Earn an interest rate that beats inflation

- Enjoy a reliable absolute return

- Safety from creditors

- CPF Special Account can be used to invest

1. Earn an interest rate that beats inflation

For a retirement fund to be viable, it must grow at a pace that beats inflation. This is usually 3% for Singapore and most developed countries (central banks take great efforts to keep inflation in this range, for reasons we won’t go into here).

This means your retirement fund should be getting at least five per cent per annum, which your SA does. There are plenty of other investment options out there — but an insurance policy straggling around at four per cent, or Singapore Savings Bonds at between two to three per cent, don’t really cut it.

2. Enjoy a reliable absolute return

If you were to use mutual funds or Exchange Traded Funds, your returns will fluctuate based on the index it’s pegged to.

For example, if you buy a mutual fund pegged to the S&P 500, and the S&P 500 falls to negative 1.2 per cent returns, you would probably get negative 1.3% return. If returns are a positive two per cent, you might get 1.9 per cent (it’s not exact to account for expense ratios).

Over the long term, all of this should even out. However, there’s always a chance that you’re one of those unfortunate investors who see more bad years than good ones. It’s not likely, but it could happen.

The great thing about the CPF is that returns are absolute. If the SA interest rate is 5%, then you get 5%, regardless of how well or how badly Singapore is doing.

Coupled with the fact that it’s guaranteed by the Singapore government, this is one of the safest investments available to you.

3. Safety from creditors

Even if you go bankrupt, your creditors cannot take money from your CPF. This isn’t too big a deal for most people (most of us never reach that stage). But if you’re a stay-at-home Forex trader or a business or start-up owner, this is important.

4. CPF Special Account can be used to invest

Beyond the minimum balance of S$40,000, savings in your CPF Special Account can be used to invest in any of the approved investment schemes below. But before you do, make sure you can get the same or better returns than the maximum 5% interest on your SA account. Also take note that any profits go straight back into your SA account, which you can only withdraw at the age of 55. Below are the investment assets available to you:

- Fixed deposits

- Treasury bills

- Singapore government bonds

- Unit trusts

- Annuities

- ETFs (Exchange Traded Funds)

- Endowment policies

- Investment-linked insurance products

- Statutory board bonds

Cons of keeping your savings in your CPF Special Account

There are a number of issues you may face:

- You have to pay for your housing the hard way — in cash

- You’ll need to rely on banks for education loans

- Transfer from OA to SA are permanent and irreversible

1. You have to pay for housing the hard way

When you take an HDB Concessionary Loan, you need to pay at least 10 per cent of the flat price. This can come from your CPF OA or your pocket. And since you have transferred everything from the OA to the SA, your pocket it is.

A three-room flat costs around S$350,000. This means you should be prepared to fork out at least S$35,000 in cash somehow (a little less after grants).

If you are buying private housing or an Executive Condominium (EC), you will have to take a bank loan and put down 20 per cent. So a $700,000 EC would mean a cash payment of $140,000, if you have nothing in your CPF OA.

In addition, many Singaporeans pay their mortgage through their CPF OA. This will, of course, not be an option for you if all the money has been transferred to your SA.

You have to be very disciplined at money management, in order to make the significant down payment without CPF. And because you are paying the mortgage in cash, you will have to plan your monthly finances carefully. This is exactly what Singaporean Loo Cheng Chuan, aka Mr CPF, did to accumulate a million dollars in his CPF account — he saved and scrimped during his early years of his career, and is now reaping the benefits.

For bank loans, this entails knowing details like when to refinance, or how to pick between one and three-month interest rate periods with the most efficiency. Compare home loan interest rates on SingSaver to find the best loan that suits your needs.

2. You’ll need to rely on banks for education loans

Your CPF OA can be used for education loans when applying for studies from a recognised institution (and yes, you do have to pay back your CPF account, with interest!).

If you have not completed your diploma or degree but intend to, you will have to turn to banks if your OA is empty. If you do decide to take out an education loan from a bank, be sure that you are careful to repay on time. Failure to do so can greatly impact your credit score later.

Compare and apply for the best personal or education loans on SingSaver and choose the one that best suits your needs based on your desired loan amount and tenure.

3. Transfers are permanent and irreversible

Transferring savings from Ordinary Account to Special Account is permanent and irreversible. If you have a sudden need for cash, you cannot undo the process. If you’re still young, that means you first have to build up an emergency cash fund (roughly 6 months of your monthly salary) and then gradually transferring what savings you feel comfortable with to your SA.

You will only be able to withdraw savings in the CPF Special Account when you reach the age of 55, which is when the savings from the SA will be transferred to your retirement account. This retirement account can then be used to join CPF Life, which offers lifelong monthly payouts to CPF members.

Conclusion

Given that the SA offers very decent interest rates and is guaranteed, many Singaporeans would be better off gradually transferring money and building up their SA nest egg, provided they have planned ahead and have enough cash savings to last until the age of 55.

This article was republished with permission from SingSaver. SingSaver is a personal finance comparison platform which provides free, quick and easily accessible resources to help consumers understand personal finance products in Singapore; including credit cards, personal loans and travel insurance.

If you would like to get the maximum rewards from your credit cards, do consider integrating WhatCard into your lifestyle to help you optimize your credit card rewards, and follow us on Facebook to stay updated on the latest tips, tricks, and hacks (like this article!) to get the most out of your credit cards

If you enjoyed this article, you may also be interested in:

- Why I'm still using my YouTrip card during CB

- What is the value of a mile in the post Covid-19 world?

- 2 Months Promo: Get 10% cashback for online spending through DBS Live Fresh!

- Anatomy of the real responsible investing firm

- WhatCard’s list of best credit card sign up promotions

- This is how you set up ipaymy to reduce your IRAS tax payments

- WhatCard’s list of best credit card sign up promotions

- Why do so many people continue to use their EZ-Link cards for MRT/Bus payments? !