From time to time, we get requests from friends and family on what they should invest in for them to be a step closer towards financial freedom (even though we spend most of our time thinking and writing about credit card rewards  ). Our friends and family are sometimes skeptical of the recommendations from their financial advisors, as well as what they might have read online or heard from other friends, and wanted to hear our opinions.

). Our friends and family are sometimes skeptical of the recommendations from their financial advisors, as well as what they might have read online or heard from other friends, and wanted to hear our opinions.

Before thinking about what to invest in, we would usually recommend that people first get a better understanding about why they are investing and their own personal circumstances before determining the appropriate investment strategy. Today, we will share with you readers a framework that we would recommend for you to think through some important points before you start investing.

Just like how a winning credit card strategy starts by understanding your own situation (e.g. your income, expenses, miles vs cashback preferences) between determining which cards can help you get the optimal rewards, so too does having an investment policy statement help you lay out the game plan for you to be financially independent if executed consistently.

What is an investment policy statement?

An investment policy statement is a simple document that establishes your preferences and personal circumstances clearly and concisely. It is exhaustive in the sense that it will capture all the critical dimensions there is to be considered in your life journey. We had learned about the investment policy statement as part of the CFA (Chartered Financial Analyst) curriculum and found it to be extremely practical and useful. To complete it, pen down your responses to the following 3 questions:

1. What is your investment return objective?

One response that people often give when asked about investment returns is that they want it to be “as high as possible!!”. While everyone loves to have high investment returns, saying that they want the highest possible investment returns is not very helpful, as getting higher returns is usually associated with higher risk of losses. Want to get rich really fast? You could start a pyramid scheme and be filthy rich as long as you can avoid getting caught and end up going to jail / ruining your career

Instead, you should be determining a target investment return based on your personal financial goals.

For those with great clarity of the investment outcome they want for their portfolio, they will easily be able to crystallize what they are looking for into a number, such as 8% net (after tax, fees, etc) returns a year. For others, this might be a tricky question to answer. What we found helpful is for you to condense a qualitative goal of what you want into these numbers.

For example, if you are 30 years old targeting to retire by age 60 and have enough savings to have a monthly spending of $5,000 (in today’s dollars) till the age of 80, you will need to have savings for 20 years x 12 months x $5,000/month = $1,200,000 at age 60. If you are able to save $1,000/month over this 30 period before you retire, you would need an investment return of ~7% per year.

We are leaving out some of the math here, you can derive this using an annuity formula/calculators that you can find online or on Microsoft Excel.

If you make a simple assumption that inflation is 2%, then you would need to target ~9% nominal after tax investment returns to meet your personal retirement goals.

2. What is your risk tolerance?

As mentioned, higher investment returns usually come with higher risk as well.

For those able to articulate a risk tolerance (i.e. volatility of 10%, maximum drawdown of 10%, 90% chance to lose no more than 10% of portfolio), you can move on to the next aspect of the investment policy statement. If you can’t articulate this, try to triangulate from a few qualitative data points:

- How much time do you have to reach your goals? The more time you have (the younger you are), the greater your ability to take risks as you are able to ride out ups and downs in your investments

- Do you have dependents? If yes, you would usually want to take less risk as you have to ensure that you are able to continue to care for your dependents.

- How important is this goal to you? If it is very important, it lowers your ability to take risk. For example, if it is very important to you to have $100,000 saved up within 3 years to place a downpayment for a house before you decide to get married, you would want to take less investment risk to avoid disrupting these plans.

- Can you stomach a volatile portfolio that can potentially be down 25%? It is hard to predict how you would respond given large decreases in your investments, but thinking through your likely emotional reaction to such a loss would help you to better understand what kind of risk you are personally able to stomach to achieve the returns that you seek.

3. What are your other constraints?

As you work towards your financial goals with your return objective and risk tolerance, sometimes you need to make small tweaks to this long-term plan to accommodate certain constraints. There are many potentially important points that are often missed when people jump straight into investing without having properly thought through their overall approach. Some of the main ones to consider are:

- Time horizon (it is helpful to know how long you can accumulate your portfolio for, this is one of the inputs to a qualitative risk assessment above)

- Tax considerations (it is more useful to plan an overall portfolio optimization alongside SRS and CPF funds, which can lower your taxes paid )

- Liquidity (do you have an upcoming expense soon? do you have recurring medical expenses to pay? if so a higher fixed income allocation may be better for you)

- Legal (most likely this doesn’t applies to you; it applies to people who may have assets in a listed entity (the entrepreneur/founder of Uber may have a lot of Uber stocks, and it may be a different process in dispose his/her stock position compared to other investors). These people should seek legal advice before planning their investment policy statements)

- Unique circumstances (most likely this doesn’t applies to you, unless you have very strong views, i.e. no stocks in tobacco-related companies. If so, the financial advisor will construct a portfolio that reflects your wishes)

If you are curious how an example of a completed Investment Policy Statement looks like, you can see a sample published by Investopedia here.

How do I use my investment policy statement?

If you are navigating the world of investments, you would probably get bombarded with information and don’t know where to begin. At the beginning, we too did not know what was actionable to us when the GDP of Singapore fell 2% year-on-year, or the implications of the US Fed announcing interest rate cuts.

The investment policy statement gives you a personalized strategy for you at a strategic asset allocation level. This means, the relevant question to ask in investments is not “should I buy DBS or UOB stock”, but is “how much in each asset class should I buy”, because studies have shown that asset class allocation determines 90% of investment returns.

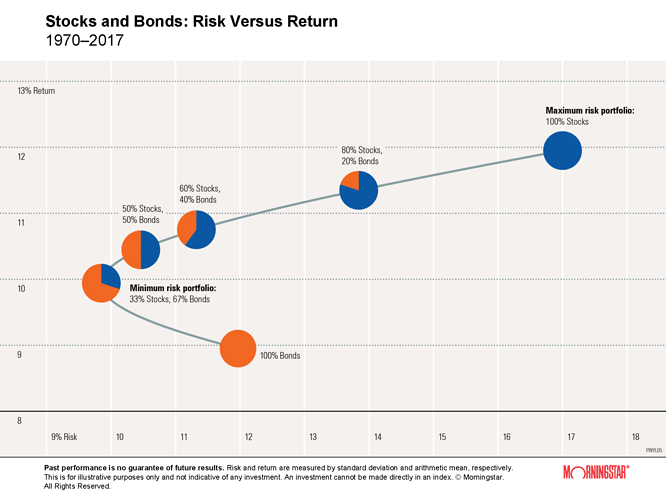

The chart below a potential reference point for how much stocks and bonds you should own as a percentage of your two asset class portfolio. If, through your investment policy statement, you realize that you need a 10% investment returns with 10% volatility to meet your goals, you might want to consider a 33% stock, 67% bonds portfolio. The curve connecting all the portfolios together here represents something known as an efficient frontier; you generally want to be investing in a portfolio that is on the top half of the curve because it gives the best risk-adjusted returns.

Chart obtained from https://boyd-wealth.com/blog/prudence

Another way to use the investment policy statement is to consider new investments in the context of your existing portfolio. When you encounter a new investment opportunity (i.e. if you find yourself thinking “is it time to buy gold now?”) , you should observe the historic volatility and returns of that investment, and make a judgement on whether it would perform a certain way given the current market environment. Simulate an allocation to a new portfolio (i.e. a 30% stocks, 60% bonds, 10% gold portfolio) to see what the expected returns and volatility looks like. If the new portfolio show higher returns with the same volatility, great! Make that investment, because it improved your risk-adjusted returns. If it is lower, then don’t add it to your portfolio, because your previous portfolio was already pretty good.

We are ignoring any explanations of the diversification benefits of adding a new investment in your portfolio here. People who are interested to know how gold works as a diversifier can read about it here.

This is why we generally recommend leaving portfolio construction to the pros. They are the ones making a career out of how these asset classes will perform in the next several years. If you have a financial advisor, you will also most importantly be able to work with him/her towards a perfect solution for yourself, instead of him/her trying to infer the importance of your goals and risk tolerance from your conversations.

Summary

In conclusion, we encourage you to complete your own investment policy statement by having answers to these 3 questions. It will set the blueprint for your investment portfolio, with the final objective that it will be able to realize your goals.

If you would like to get the maximum rewards from your credit cards, do consider subscribing to regular updates and follow us on Facebook to stay updated on the latest tips, tricks, and hacks (like this article!) to get the most out of your credit cards

If you enjoyed this article, you may also be interested in:

- WhatCard's list of best credit card sign up promotions

- Get $200 in cash when applying for a Citibank card. New-to-bank customers only

- Cash vs Card: Which is better for overseas expenses?

- StashAway Simple: Is it that simple?

- WhatCard of the Week (WCOTW) 15 Nov: StanChart Unlimited Card

- Best credit card to top-up YouTrip : It’s (probably) not the card you are thinking of

- Why do so many people continue to use their EZ-Link cards for MRT/Bus payments?

- Get up to 10% cashback when paying for your taxes, utilities and insurance bills with this simple trick

- 3 CPF schemes young adults should know about